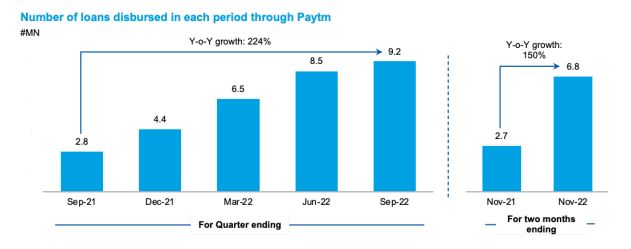

● Loan distribution business scales to 6.8 million loans disbursed during the two months ended November 2022 (y-o-y growth of 150%), aggregating to loan disbursements of Rs 6,292 Cr ($774 million, y-o-y growth of 374%)

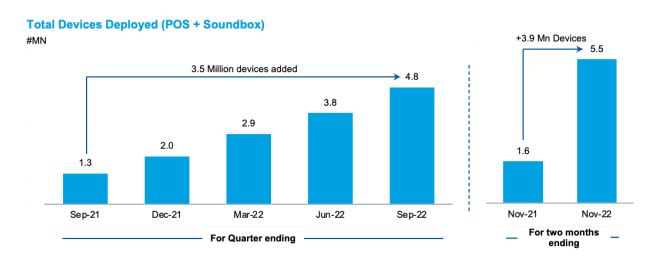

● Leadership in offline payments strengthens with merchants paying subscription for payment devices exceeding 5.5 million

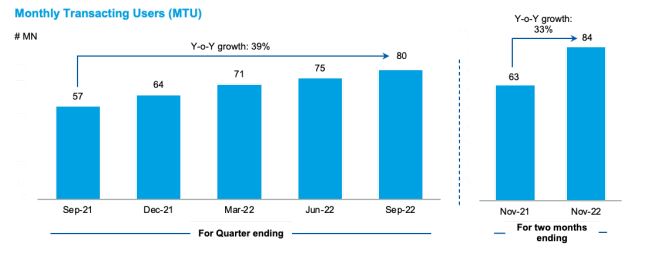

● Consumer engagement is at its highest on Paytm Super App with average monthly transacting users (MTU) at 84 million for the two months ended November 2022, up 33% y-o-y

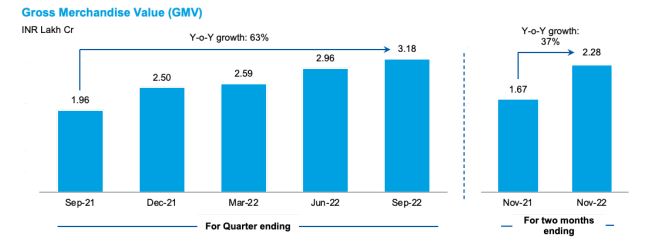

● Merchant payment volumes (GMV) for the two months ended November 2022 at Rs 2.28 Lakh Cr ($28 billion) y-o-y growth of 37%

We have achieved sustained growth in payments and loan distribution business, with 6.8 million loans disbursed in October & November 2022 and our total devices deployed increasing to 5.5 million.

You can also access our exchange filing here: https://www.bseindia.com/xml-data/corpfiling/AttachLive/9ed937b6-192f-4307-83cc-5b0340203018.pdf

Our Operating Metrics for October & November 2022 are Here:

Loan distribution business continues to scale: Our loan distribution business (in partnership with top lenders) continues to witness an accelerated growth with disbursements through our platform now at an annualised run rate of ₹39,000 crore in the month of November. The value of loans disbursed grew 374% y-o-y to Rs 6,292 Cr ($774 million), while the number of loans disbursed grew 150% y-o-y to 6.8 million cumulative loans for the two months ended November 2022. We see a significant growth runway given low current penetration, while we continue to work with our partners to remain focused on the quality of the book.

New milestone in offline payments leadership: We continue to strengthen our leadership in offline payments, with more than 5.5 million merchants now paying subscription for payment devices. With our subscription as a service model, the strong adoption of devices drives higher payment volumes and subscription revenues, while increasing the funnel for our merchant loan distribution.

Robust growth in MTU: The Paytm Super App continues to see growing consumer engagement with the average MTU for the two months ended November 2022 at 84 million, registering a growth of 33% y-o-y.

Consistent growth in total merchant payments volume: The total merchant GMV processed through our platform for the two months ended November 2022 aggregated to Rs 2.28 Lakh Cr ($28 billion), marking a y-o-y growth of 37%. Our focus over the past few quarters continues to be on payment volumes that generate profitability for us, either through net payments margin or from direct upsell potential.